Fiduciaire de Preux & Associés SA is a family-run business, founded by Michel de Preux and passed on to his son Eric, ensuring the continuity of the structure and the satisfaction of its loyal clientele.

We offer fiduciary services to corporate and private clients. Our range of services includes, among others:

- Audit

- accounting (restricted, ordinary or special controls)

- taxation

- payroll processing

- of the board :

- Administrator, manager or liquidator services

- Company start-ups, liquidations, mergers, conversions or transfers

- Estate planning

- Retirement planning (life cycle)

- Drawing up business plans and budgets

- analysis, cost accounting and investment decision support services (CFO)

Fiduciaire de Preux is a member of EXPERTsuisse and approved as an auditor by the Swiss Federal Supervisory Authority (ASR) under Register No. 501’124.

The trust has been certified ISO 9001 by SGS since its creation.

We have over 30 years’ experience in auditing and wealth, tax and financial advisory services for SMEs and Swiss and international organizations operating in Geneva and the Lake Geneva region.

de Preux

In addition to their auditing, tax and consulting activities, Michel and Eric de Preux have been directors of numerous Swiss and international companies for many years.

We currently employ around ten professionals with many years’ experience in the fiduciary field, who undergo regular further training.

Read more

Can you keep professional and personal accounts

If we handle corporate accounting, we can also take care of private accounting if you wish.

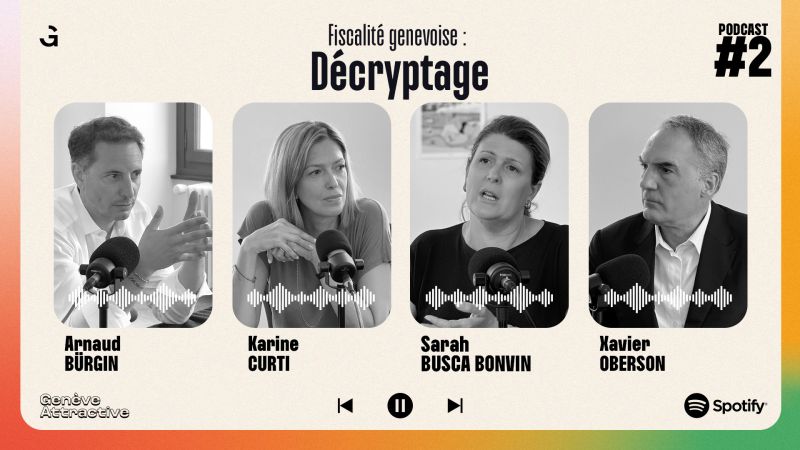

What is your expertise in Swiss taxation?

We have an excellent knowledge of Swiss taxation of individuals and companies at federal level (DFI, withholding tax, VAT, etc.).

In terms of cantonal taxes, we have considerable expertise in the cantons of the Lake Geneva region.

As with all our activities, we don’t hesitate to call on our network to validate certain delicate points, or to request validation directly from the relevant authorities.

Do you have any advice on setting up a business in Switzerland?

Yes, of course. We start by talking to the customer to define the objectives, means and scope of the business. The domicile of the founders and the existence of a sole proprietorship are also crucial at this stage in choosing the most suitable structure. Next, we draft a letter for a notary (chosen by the customer or from our network) to formalize the creation of the company. We can also advise on accounting, registration with social security bodies (AVS, LPP), loss-of-earnings insurance and VAT registration.

Do you need original paper documents for bookkeeping?

Swiss standards still require that accounting records be kept for 10 years, or even 20 years in the case of real estate, or that accounting records be digitized according to very strict standards, which require special software (Olico).

In practice, however, VAT controllers, for example, make do with standard PDFs, in our experience.

To optimize exchanges with our customers as part of our accounting services, we are increasingly using shared directories (Sharepoint) or, more recently, Deepbox, an intelligent mailbox serving as a platform for electronic exchange and automated document processing, enabling us to integrate accounting documents directly into our Abacus software. For the reasons outlined above, customers should nevertheless retain paper documents.